Bike Stunt Racing Game

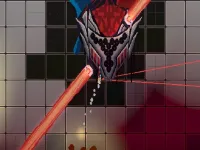

Space Shooter Boss

Drive and Avoid!

CANDY MATCH 3 KIT 2025

Pickle Ball Clash

Passing master 3D

Obby: Working as a Firefighter

Obby: Dig to the center of the Earth

Noob vs Pro But Floor is Lava Minecraft

Rogue Runner

Neon Ball Slope

Xtreme Good And Bad Boys 2 2025

FRAGMENT

Tralalero Tralala Endless Run

Feed Monster Game

In today’s fast-paced urban environments and increasingly congested roads, owning a two-wheeler whether it’s a sleek commuter scooter, a rugged adventure motorcycle, or a vintage classic comes with a unique set of risks. From sudden accidents and thefts to third-party liabilities and natural disasters, the potential for financial loss is significant. That’s where bike insurance steps in as a critical safety net. In 2023, with rising vehicle costs, stricter traffic regulations, and growing awareness about road safety, having comprehensive bike insurance isn’t just a legal requirement in many countries it’s a smart financial decision.

In India, for instance, the Motor Vehicles Act mandates at least third-party liability coverage for all two-wheelers. But savvy riders are going beyond the basics, opting for comprehensive policies that cover everything from accidental damage to personal injury. As the insurance landscape evolves with digital innovation, customer-centric features, and competitive pricing, choosing the right provider can make all the difference between a stressful claim process and a seamless, hassle-free experience.

This guide dives deep into the top five bike insurance companies of 2023 evaluated not just on premium costs, but on claim settlement ratios, customer service, digital tools, policy flexibility, and overall value. Whether you're a daily commuter or a weekend road-tripper, knowing which insurer has your back can bring peace of mind every time you twist the throttle.

For a broader understanding of how vehicle insurance works globally including historical context and regulatory frameworks you can explore the Wikipedia page on vehicle insurance , which offers a comprehensive overview of the industry’s development and key principles.

Before we unveil our top picks, it’s essential to understand the criteria that separate an average insurer from an exceptional one. In 2023, the best bike insurance companies go beyond offering low premiums. They deliver a holistic experience that prioritizes the rider’s needs at every stage from policy purchase to claim settlement.

Claim Settlement Ratio (CSR): This is perhaps the most telling metric. A high CSR (typically above 90%) indicates that the insurer approves and pays out the majority of legitimate claims. It reflects reliability and trustworthiness.

Digital Experience: With the rise of fintech and insurtech, customers expect seamless online processes quick quotes, paperless documentation, instant policy issuance, and mobile app support for claims and renewals.

Add-on Flexibility: The best policies allow riders to customize coverage with useful add-ons like zero depreciation, roadside assistance, engine protection, and personal accident cover.

Customer Support: 24/7 helplines, multilingual assistance, and responsive grievance redressal mechanisms are non-negotiable in emergencies.

Network of Garages: A wide network of cashless repair garages ensures that policyholders don’t have to pay upfront for repairs after an accident.

Transparency & Fair Pricing: Clear policy wordings, no hidden clauses, and fair premium calculations based on actual risk not just age or brand are hallmarks of ethical insurers.

Keeping these benchmarks in mind, let’s explore the five standout bike insurance providers of 2023.

Bajaj Allianz has consistently ranked among India’s top general insurers, and its two-wheeler segment is no exception. In 2023, the company reinforced its leadership through cutting-edge digital integration and customer-first policies.

Why It Stands Out:

Bajaj Allianz offers one of the fastest online bike insurance purchase processes often completed in under three minutes. Their mobile app allows users to upload photos of damages for instant claim estimates, track repair status, and even renew policies with a single tap. The insurer boasts a claim settlement ratio of over 94%, one of the highest in the industry.

Key Features:

Ideal For: Tech-savvy riders who value speed, transparency, and digital convenience without compromising on coverage depth.

A joint venture between HDFC Bank and ERGO International, HDFC ERGO has built a reputation for empathetic service and innovative product design. Their bike insurance plans are tailored for both urban commuters and long-distance enthusiasts.

Why It Stands Out:

HDFC ERGO’s “Quick Bike Insurance” allows instant policy issuance with minimal documentation. Their claim process is notably rider-friendly customers can file claims via WhatsApp, a feature that proved invaluable during the pandemic and remains popular in 2023. The company maintains a CSR of approximately 93%, backed by a responsive customer care team.

Key Features:

Ideal For: Riders who prioritize personalized service, multichannel support, and value-added benefits like NCB protection.

ICICI Lombard has long been a trailblazer in the Indian insurance space, and its two-wheeler offerings reflect that spirit of innovation. In 2023, the company introduced AI-driven risk assessment tools and dynamic pricing models that reward safe riding behavior.

Why It Stands Out:

Through its “Safe Drive” program, ICICI Lombard uses telematics (via a mobile app) to monitor riding habits like sudden braking, night driving, and speed patterns. Safe riders earn discounts of up to 20% on renewal premiums. The insurer also offers one of the most transparent claim tracking systems, with real-time SMS and email updates.

Key Features:

Ideal For: Safety-conscious riders who want to be rewarded for responsible behavior and enjoy tech-enhanced policy management.

Backed by the State Bank of India, SBI General brings the credibility and stability of a public-sector giant to the bike insurance market. While often perceived as traditional, the company has significantly modernized its offerings in 2023.

Why It Stands Out:

SBI General combines affordability with reliability. Their basic third-party plans are among the most competitively priced, while their comprehensive policies include robust add-ons at lower costs than many private players. The insurer’s claim settlement ratio hovers around 92%, and its grievance redressal system is highly structured, making it a solid choice for first-time bike owners.

Key Features:

Ideal For: Budget-conscious riders, new bike owners, and those who prefer the trust and reach of a government-associated brand.

Often underrated but highly effective, Cholamandalam MS (a collaboration between the Murugappa Group and Mitsui Sumitomo Insurance) excels in tailored solutions for diverse rider profiles from delivery fleet operators to vintage bike collectors.

Why It Stands Out:

Cholamandalam offers some of the most flexible policy structures in the market. For example, their “Custom Bike Insurance” allows coverage for modified parts, custom paint jobs, and imported accessories something most insurers exclude. Their claim process is straightforward, with a CSR of 91.5%, and they provide multilingual support across Tier 2 and Tier 3 cities.

Key Features:

Ideal For: Enthusiasts with customized bikes, electric vehicle owners, and riders in semi-urban or rural areas seeking localized service.

Selecting the best insurer is only half the battle choosing the right policy type and add-ons is equally crucial. Here’s a quick decision framework:

Third-Party vs. Comprehensive:

Consider Your Usage:

Check the Fine Print:

Finally, always compare quotes across at least three providers using online aggregators but don’t base your decision solely on price. A ₹200 cheaper premium isn’t worth it if the claim process is slow or the garage network is limited in your area.

Renew On Time: Letting your policy lapse even by a day means losing your accumulated No-Claim Bonus (NCB), which can reduce premiums by up to 50% over five claim-free years.

Install Anti-Theft Devices: Many insurers offer discounts (5–10%) for ARAI-approved anti-theft systems. It’s a small investment with dual benefits.

Bundle Policies: If you also own a car or home, check if your insurer offers multi-policy discounts.

Document Everything: Keep photos of your bike’s condition at policy start. In case of a dispute, this visual evidence can speed up claims.

Review Annually: Your bike’s value depreciates, but your needs may change. Reassess add-ons and coverage every renewal cycle.

Q1: Is third-party bike insurance enough in 2023?

While legally sufficient, third-party insurance only covers damage or injury you cause to others. It does not cover repairs to your own bike, theft, or fire damage. For complete protection, a comprehensive policy is strongly recommended.

Q2: Can I transfer my No-Claim Bonus (NCB) to a new insurer?

Yes. NCB is linked to you, not the insurer. Provide your previous policy’s NCB certificate when switching, and the new company must honor it.

Q3: What is zero depreciation cover, and do I need it?

Zero depreciation (or “bumper-to-bumper”) cover ensures you receive full claim amounts without deductions for wear and tear on parts like plastics, rubber, or fibers. It’s especially valuable for new bikes (under 5 years) and frequent riders.

Q4: Are electric bikes covered under standard bike insurance?

Most standard policies now include electric two-wheelers, but confirm that the battery and motor are explicitly covered. Some insurers offer specialized EV plans with extended battery warranties.

Q5: How long does a bike insurance claim take to process?

With digital insurers like Bajaj Allianz or ICICI Lombard, minor claims can be settled in 24–48 hours. Complex cases (e.g., total loss or theft) may take 7–14 days, depending on documentation and investigation.

Q6: Can I insure a modified or vintage bike?

Yes, but standard policies often exclude non-factory modifications. Companies like Cholamandalam MS offer custom coverage for such bikes just declare all modifications upfront to avoid claim rejection.

Q7: What happens if I don’t renew my bike insurance on time?

Your policy lapses, and you lose legal coverage. If caught riding without insurance, you face fines under the Motor Vehicles Act. Additionally, you forfeit your NCB, and reinstating coverage may require a fresh inspection.

Q8: Is online bike insurance as valid as offline?

Absolutely. Online policies are legally identical to offline ones and often come with added benefits like instant issuance and e-policy storage. Always verify the insurer is IRDAI-registered.

Choosing the right bike insurance in 2023 is about balancing cost, coverage, and convenience. With the top five providers outlined above each excelling in different areas you’re well-equipped to find a plan that matches your riding style, budget, and peace-of-mind needs. Stay protected, ride safe, and enjoy the open road with confidence.